How does all this description of trends and RMs help your trading?

RMs are roadblocks on price motion, knowing where they are will help you in several ways.

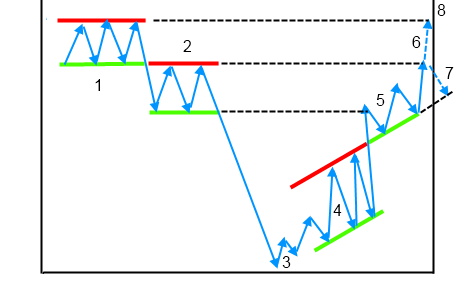

Let’s look at the previous picture again:

Once you read the graph, you may see how the action tends to happen close to those support and resistance lines, not in random space. That is, the market moves randomly but with a meaning. There are elements that help determining possible next moves and avoiding costly mistakes.

Once you read the graph, you may see how the action tends to happen close to those support and resistance lines, not in random space. That is, the market moves randomly but with a meaning. There are elements that help determining possible next moves and avoiding costly mistakes.

After learning the previous chapters, would you decide to buy stock when price is a bit below the top of the RM marked as “2” just because it’s a “dip” below the RM marked as “1”? No, right?

Would you buy where price breaks thru RM marked as “1” before bumping at the base of RM “2”? NO! Nothing tells us that price is not going to do what happens when it breaks thru RM “2” and dives all the way down to “3”.

Would you buy once down at “3”? No, because once again, we have no elements hinting at the market having actually reached the deepest bottom. Once price retraces (a more formal term for “bumping”) on itself past “3” and fails to dive deeper with a new lower low, then we may decide to buy stock.

Buying at the base of dynamic RM “4” would be a safer decision. It seems that demand and supply are keeping it above the dynamic support (unlike for fundamental market analysis we don’t care about why this is happening) and therefore it may be feasible to buy at one of the 3 dynamic RM “4” bottoms.

Is it smart to hold the stock once price climbs to the top of dynamic RM “4” (before piercing the red colored dynamic resistance)? NO! Nothing tells us that price will pierce thru before that event actually happens.

Remember, in trading the most important safeguard is called capital preservation.

It’s always better to let the other traders risk their neck by holding stock at a known resistance line. The trader willing to keep his capital, will sell (potentially causing the downwards motion back inside the RM if his stock is big enough!) at the top and eventually re-purchase the stock once price is above that resistance and has now safely retraced back at the base of dynamic support “5”.

Likewise at “6”: will price break thru the long time resistance and go to 8 or will it bounce back to 7? We cannot know the future, just that something will happen at the “6” “market decision point”. Therefore the safest strategy is to unload at least some of the stock and wait for the market to tell us what it wants to do. The market deserves respect and responsible actions, it punishes trespassers in the most harsh ways.

The trader is not a voodoo practicing wizard, but a very patient person who waits for the market to clearly tell what it wants to do first.

Surely, nothing in trading is foolproof and guaranteed to work, price may decide just to act funny and senseless but with tecniques called “money management” it’s possible to largely offset the inevitable losses and turn up a tidy profit.

The above tips seem only tailored for longer term traders, are them useless for high frequency traders?

Not at all. Even a cursory analysis of a market may reveal you are about to be fooled by a market manipulation, that your efforts will soon crash into a blocking huge order that acts as unsormountable support and so on.

An expecially useful information is to learn in advance how price just broke support. Now, unlike other traders loaded with stock like you are, you know you are in great danger. As explained in previous chapters, once a support (or resistance) breaks, price moves with great speed until it hits the next underlying roadblock. Your reading of the market may be the factor that lets you dump everything for a small loss instead of looking like one of the many “I have these 3 billions of stock that now have plummetted, I’ll hold them till price turns back up”.

You will have 2.95 billions free to use in another potentially winning market, while the “buy and hold” guys will have 3B locked down for months in a falling market that might never recover back again.

In the next installments we’ll cover some further, advanced information, like: “how to taste the market’s today’s pulse?”. Once again, the concepts will cover both position and high frequency traders.

Comments