Consulting

Consulting

Performance audit report about Jake Andarius operation

This is Vaerah Vahrokha’s analysis as of 2012-04-17 22:00 EvE Time.

NEISIN code: GFATCOPBO027.

Official discussion: link to investment prospectus.

Public Audits Record (PAR) for this investment: backlink.

Tools used

jEveAssets

EvE Income Analyzer Crucible Edition

EvE Mentat

Microsoft® Excel™

Blender 3D => LuxRender

Paint.NET => Bolt Bait Pack, DPY Plugins, MadJik Pack, Vandermotten Effects

Forewords about the Audit

Jake Andarius is an high sec trader and mission runner.

He contacted the Auditor to get a performance audit prepared.

This audit will cover the trading activities past performance and his NAV.

Involvement in other business

Jake Andarius has liabilities for 3,601,728,548.20 ISK due to private investors (friends).

Net Asset Value and other balance considerations

The estimated net worth of all liabilities, solid & liquid assets is about 9.270B ISK.

Market transactions are made by the Investee character.

Assets across all of the characters and corporations are estimated to be worth 0.653B.

Important notice: the reported values may be lower than the real amounts, because certain assets in certain conditions are not reported by the API.

Assets and balance

| 1">audit-record" style="text-align: left;" colspan="3">Balance | ||

|---|---|---|

| Wallet balance: | 12.219 | B |

| Market sell-orders: | 0.000 | B |

| Market escrow: | 0.000 | B |

| Contracts: | 0.000 | B |

| Investments / receivable: | 0.000 | B |

| Liabilities / payable: | (3.602) | B |

| Total: | 8.617 | B |

| 1">audit-record" style="text-align: left;" colspan="3">Assets | ||

|---|---|---|

| POS: | 0.000 | B |

| Fleet / ships (unfitted): | 0.449 | B |

| Modules: | 0.163 | B |

| Misc. solid assets; minerals, salvage, ice and trade goods etc.: | 0.000 | B |

| Blueprint copies and originals: | 0.000 | B |

Other | ||

| Accessories (includes PLEXes): | 0.000 | B |

| Charges: | 0.009 | B |

| Commodities: | 0.000 | B |

| Drones: | 0.031 | B |

| Ordered assets under construction: | 0.000 | B |

| Planetary items or resources: | 0.000 | B |

| Ship components: | 0.000 | B |

| General or classified items: | 0.001 | B |

| Total: | 0.653 | B |

Estimated grand total: 9.270 Billion ISK

The above evaluations were made by using The Forge prices as reference.

Comparison with the previous audit reported NAV

| Wallet | ||

|---|---|---|

| Previous | 4.777 | B |

| Current | 8.617 | B |

| Difference | 3.840 | B |

| Change | 180 | % |

Notice

Before this report was created, Jake Andarius incurred in the following expenses:

400M – Payment for standing services

450M – Payment for standing services

550M – Payment for standing services

1B – MD Borrowers and Trustees fund deposit

Without those expenditures, the current wallet worth would be 11.017B for a bond performance of 230%.

| Liabilities | ||

|---|---|---|

| Previous | 2.351 | B |

| Current | 3.602 | B |

| Difference | 1.251 | B |

| Change | 153 | % |

| Assets | ||

|---|---|---|

| Previous | 0.494 | B |

| Current | 0.653 | B |

| Difference | 0.159 | B |

| Change | 132 | % |

| NAV | ||

|---|---|---|

| Previous | 5.271 | B |

| Current | 9.270 | B |

| Difference | 3.999 | B |

| Change | 176 | % |

Markets performance analysis

Due to the changes in the EvE® API, none of the analysis softwares used in the past seem to work any longer. In order to improve this audit’s presentation, the Auditor ported and bug fixed one of them to the new standard. Thus EvE Income Analyzer Crucible Edition has born.

Income and expenditure

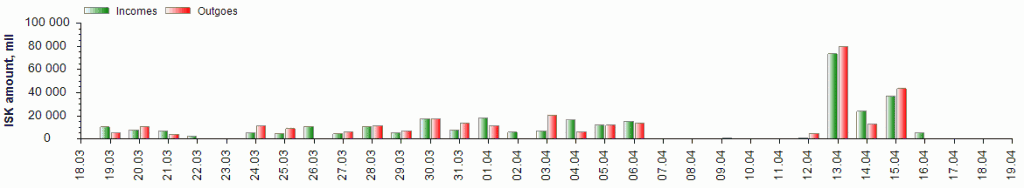

The following graph shows the income and expenditure in the last month. Expenditure includes unrealized profit and losses.

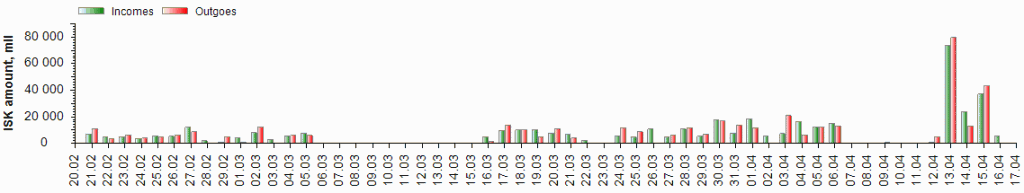

The following graph shows the all time income and expenditure. Expenditure includes unrealized profit and losses.

Wallet balance

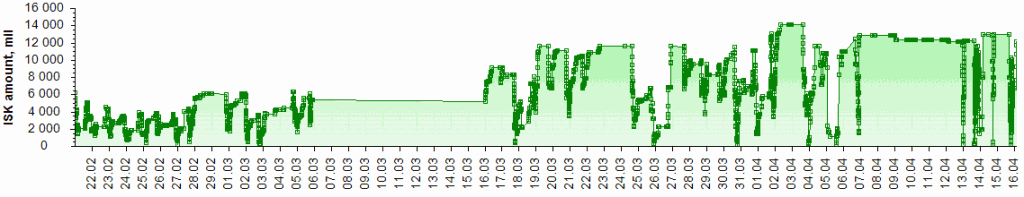

The following chart shows the variations in wallet liquidity.

Best selling items

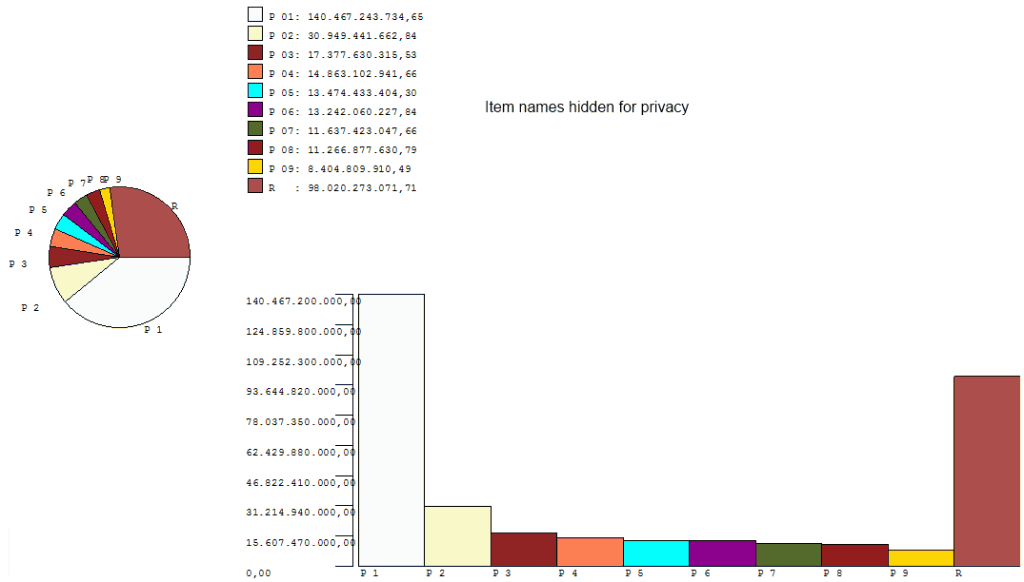

The following graph shows which items were the best selling for the full API covered period. The Investee asked to have the item names blanked.

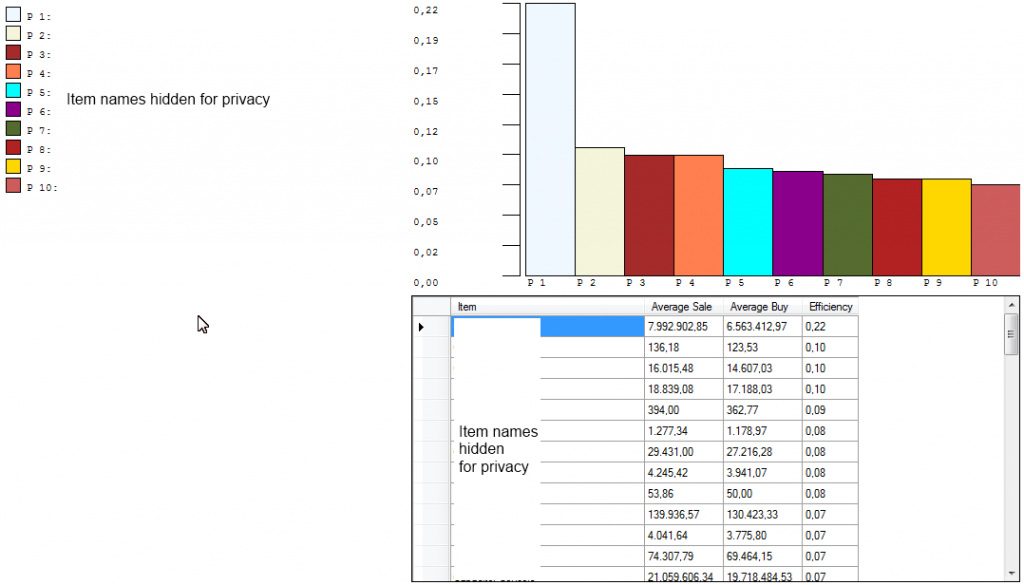

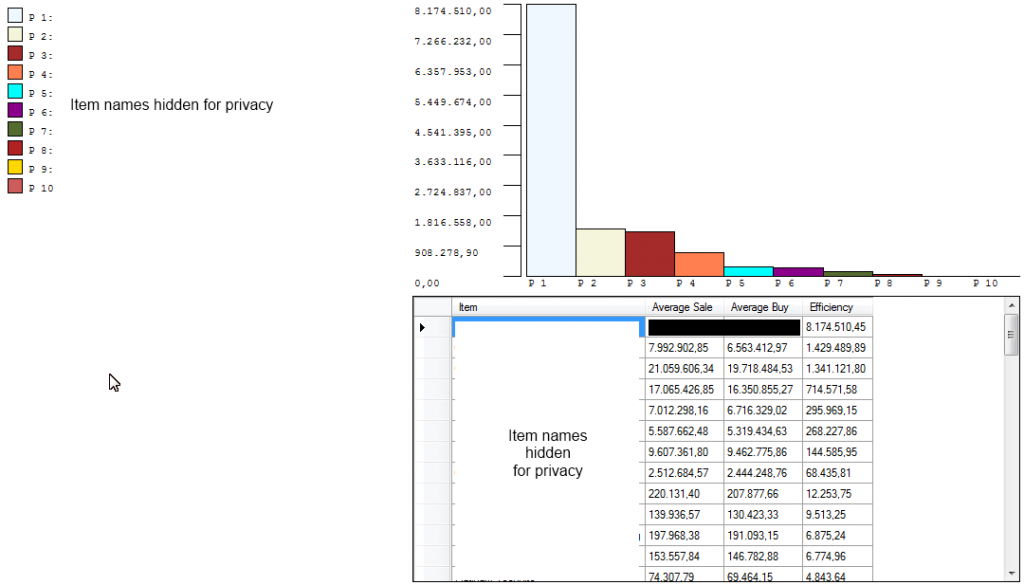

Trading efficiency

The following graph shows how much margin the Investee made by selling his stock. The “Efficiency” column shows the margin. In example, 0.22 means a 22% margin was achieved. The Investee asked to have the item names blanked. The first graph shows the relative efficiency, that is which items achieved the best margin, regardless of their actual impact on the total earnings.

The best item sales netted 22% profit.

The average sales netted a 7% profit.

The second graph shows the absolute efficiency, that is which items provided for the best total earnings margin, even if they did not achieve the best margin performance.

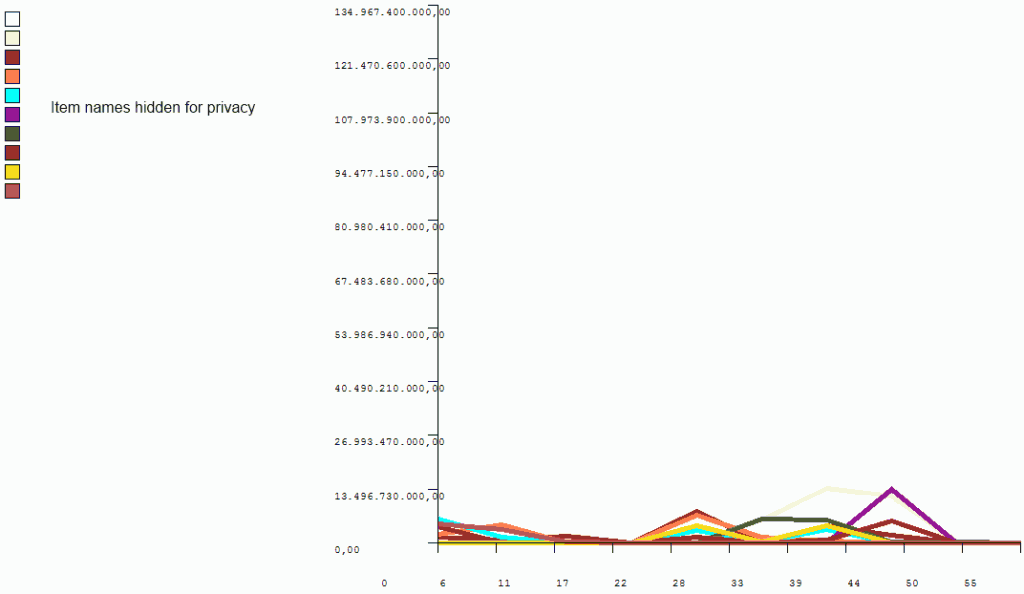

Selling speed

The following graph shows how quickly the stock moved. The Investee asked to have the item names blanked.

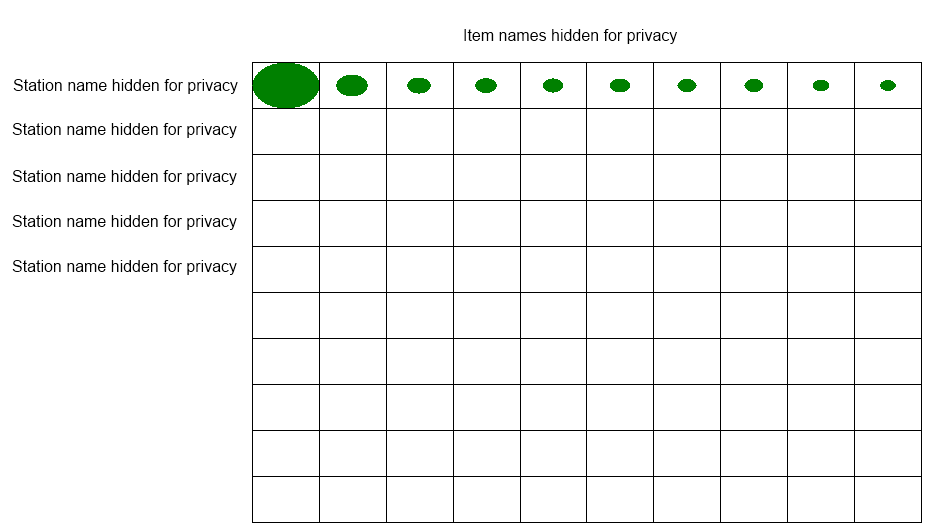

Items and markets

The following graph shows which markets had the highest turnover for which item. The Investee asked to have the item and station names blanked.

Time distribution

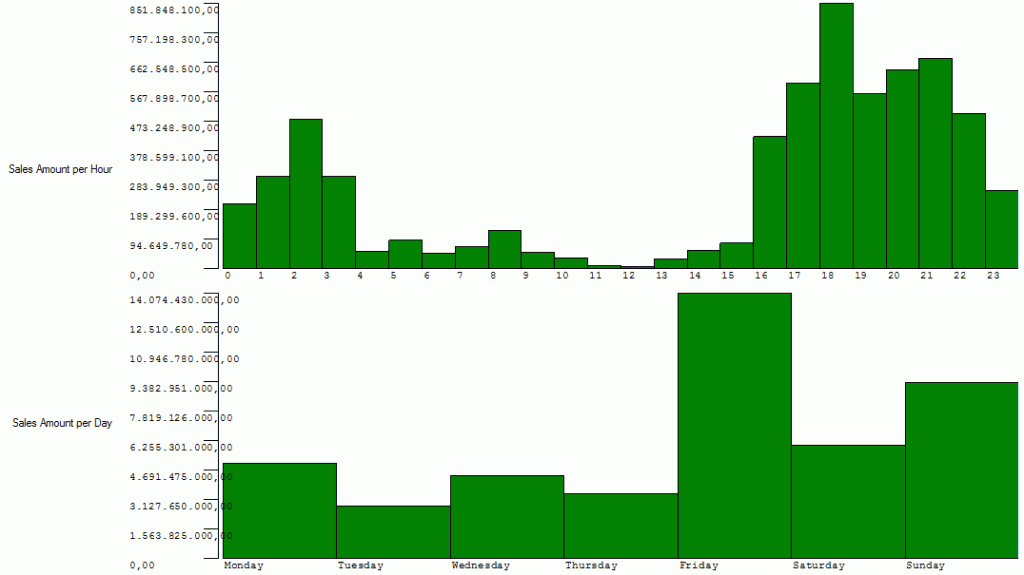

The following chart shows the time distribution (per hour and per day) of the sales.

Disclaimers

Due to stringent EvE API limitations, although the information provided to you on this document is obtained or compiled from sources believed to be reliable, Vahrokh Consulting cannot and does not guarantee the accuracy, validity, timeliness, or completeness of any information or data made available to you for any particular purpose.

This Auditor is actively and passionately against any breach of privacy, in particular regarding in game mail API access. Therefore no information will ever be gathered and no audit will ever be released that will contain any element found by eavesdropping someone else’s private communications.

Neither the information nor any opinion contained in this document constitutes a solicitation or offer by Vahrokh Consulting or its affiliates to buy or sell any securities, assets or services.