Consulting

Consulting

Audit report for Cheeba Don business proposal

This is Vaerah Vahrokha’s analysis as of 2012-05-04 14:00 EvE Time.

NEISIN code: CSUNDSCIP011.

Official discussion: link to investment prospectus.

Public Audits Record (PAR) for this investment: backlink.

Tools used

jEveAssets

EvE Mentat

Microsoft® Excel™

Blender 3D => LuxRender

Paint.NET => Bolt Bait Pack, DPY Plugins, MadJik Pack, Vandermotten Effects

Forewords about the Audit

The Investee wants to keep his corporation identity private. The corporation will be called: “Indy Corp Alpha”.

Cheeba Don is an heavily decorated 0.0 PvP player, high sec trader and manufacturer.

In order to expand on his current activity he is starting an uncollateralized IPO.

Generalities

By express indication of the Investee, this audit will exclusively cover the following points:

1) Corporation Net Assets Value.

2) Proof of production.

The Investee provided a corporation and 3 accounts characters API keys for the above assessments. The Auditor performed some addidional investigations as well.

Main character for this proposal is Cheeba Don.

Cheeba Don is a Feb 2006 character. He got 78M SP with a lot of diverse skills: from being able to fly a supercapital ship (many PvP skills trained to V) to T3 to mining to trading, PI and much more.

His alts cover leadership positions in Indy Corp Alpha and have a wide range of manufacturing, researching, invention, trading and transport skills.

Cheeba Don and his alts forum posting history is not very long. It does not show evident ill-behaviors, posts are generally about trading, manufacturing, blueprints and so on. His alts killboard shows a number of losses for a total of about 2B, mostly in low sec and mostly about cyno ships being destroyed or on another PvP alt. He killed loads though, for about 200B worth of value, with a win:loss ratio of more than 7:1.

Manufacturing statements

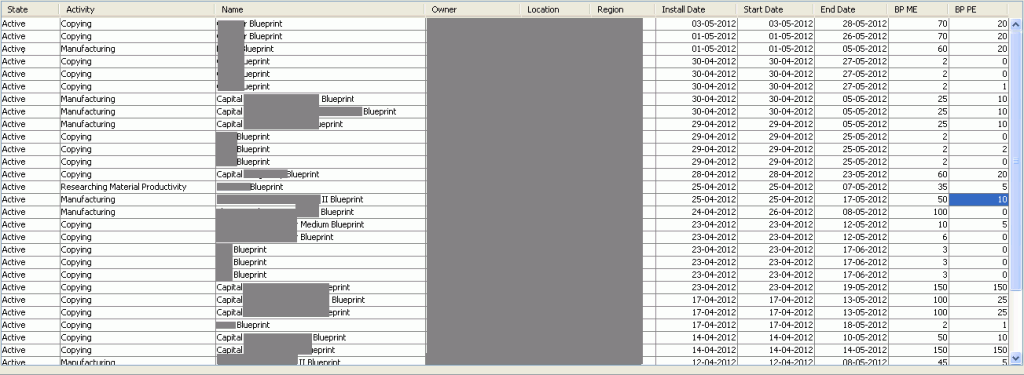

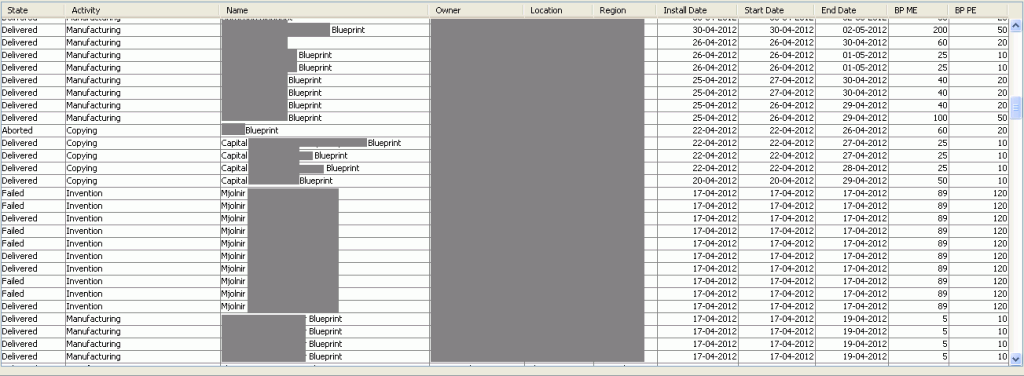

Cheeba Don alts have all sorts of manufacturing, research and invention skills. There are records about capital parts, capital ships and T2 production and invention.

Follow anonymized screenshots showing these activities:

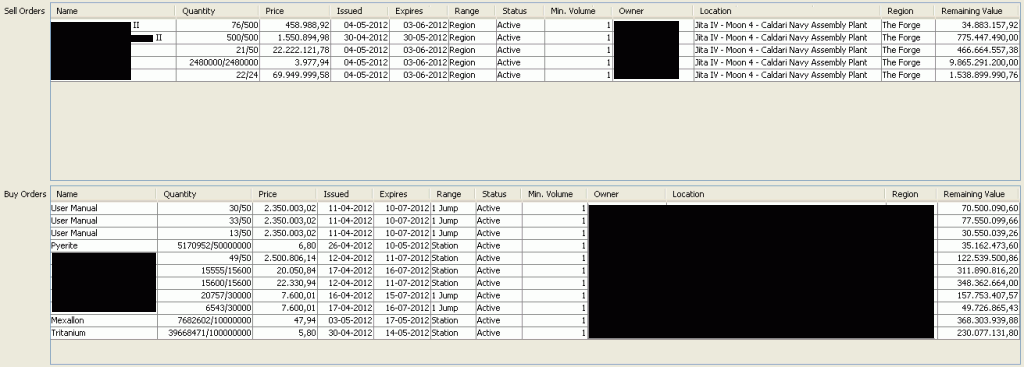

Trading statement

It’s possible to determine that Indy Corp Alpha buys the materials needed to produce tech 1 and 2 items and that sells those items on the market.

Follows an anonymized screenshot showing these activities:

Involvement in other business

Cheeba Don has not disclosed about liabilities in other business.

Business Plan Analysis

The Investee has sent the Auditor a prospectus detailing the business plan, alts assigned tasks and a possible prospectus and other data.

The Investee disclosed his strategy to the Auditor. It involves manufacturing a variety of items and selling them on the markets.

Feasibility statement: the business plan looks viable, but accurate performance data could not be gathered due to the lack of long term trading data.

Collateral and exit strategy

The Investee won’t post collateral for this IPO.

An exit strategy plan has been proposed.

Net Asset Value and other balance considerations

The estimated net worth of all liabilities, solid & liquid assets is about 319.539B ISK.

Market transactions are made either by the Investee character or another corporate character.

Assets across all of the characters and corporations are estimated to be worth 276.383B.

Important notice: the reported values may be lower than the real amounts, because certain assets in certain conditions are not reported by the API.

Assets and balance

| 1">audit-record" style="text-align: left;" colspan="3">Balance | ||

|---|---|---|

| Wallet balance: | 30.251 | B |

| Market sell-orders: | 12.681 | B |

| Market escrow: | 0.224 | B |

| Contracts: | 0.000 | B |

| Investments / receivable: | 0.000 | B |

| Liabilities / payable: | (0.000) | B |

| Total: | 43.156 | B |

| 1">audit-record" style="text-align: left;" colspan="3">Assets | ||

|---|---|---|

| POS: | 8.115 | B |

| Fleet / ships (unfitted): | 4.753 | B |

| Modules: | 3.298 | B |

| Misc. solid assets; minerals, salvage, ice and trade goods etc.: | 76.174 | B |

| Blueprint copies and originals: | 172.195 | B |

Other | ||

| Accessories (includes PLEXes): | 0.000 | B |

| Charges: | 0.097 | B |

| Commodities: | 6.415 | B |

| Drones: | 0.447 | B |

| Ordered assets under construction: | 0.000 | B |

| Planetary items or resources: | 3.522 | B |

| Ship components: | 0.000 | B |

| General or classified items: | 1.367 | B |

| Total: | 276.383 | B |

Estimated grand total: 319.539 Billion ISK

The above evaluations were made by using The Forge prices as reference.

Conclusions

Due to the lack of performance data, lack of collateral and large size of the investment, the Auditor classifies this investment as high risk.

Please notice how “high risk” does not mean “unsafe”. It’s two different concepts. Talking about high risk of bad performance, risk of real life complications etc. is one thing, the ever present chance of scam is another. The latter cannot be prevented by an audit, which only acts as first line deterrent.

Indy Corp Alpha as a whole seems competent (skills wise and player wise) enough to deliver on their statements and have past positive records. Their business is in a growth phase.

Basically, the Investee looks like having the ability to successfully honor the IPO. Notice how an audit may only evaluate the ability or potential of an Investee to succesfully honor a bond / IPO.

The Auditor suggests perspective Investors NOT to invest their full capital on this venture but to offer what they could eventually afford to lose.

Disclaimers

Due to stringent EvE API limitations, although the information provided to you on this document is obtained or compiled from sources believed to be reliable, Vahrokh Consulting cannot and does not guarantee the accuracy, validity, timeliness, or completeness of any information or data made available to you for any particular purpose.

This Auditor is actively and passionately against any breach of privacy, in particular regarding in game mail API access. Therefore no information will ever be gathered and no audit will ever be released that will contain any element found by eavesdropping someone else’s private communications.

Neither the information nor any opinion contained in this document constitutes a solicitation or offer by Vahrokh Consulting or its affiliates to buy or sell any securities, assets or services.