Consulting

Consulting

Performance audit report for Liberty Eternal business proposal

This is Vaerah Vahrokha’s analysis as of 2011-06-05 08:00 EvE Time.

NEISIN code: GFTTIXXBO052.

Official discussion: link to investment prospectus.

Public Audits Record (PAR) for this investment: backlink.

Tools used

EvE Wallet Aware

jEveAssets

EvEMeep

EvE Asset Manager

Vahrokh.com custom version of EvE Income Analyzer

Eve Trader

Microsoft™ Excel®

Blender 3D => LuxRender

Paint.NET => Bolt Bait Pack, DPY Plugins, MadJik Pack, Vandermotten Effects

Forewords about the Audit

Liberty Eternal is an high sec trader. He has succesfully started and completed the bond GFTTIXXBO052. By Liberty Eternal directions, this is a publicly disclosed performance report. Item names have not been removed.

Since the audit has been commisioned after the bond publication, market graphs only include historical data stored by the API from March 29 onwards. Assets data is a snapshot with no historical data so it may only include data from May 4 onwards. Since on May 4 the bond was already running, the first market snapshot includes the Investors capital.

May 4 assets and balance

| 1">audit-record" style="text-align: left;" colspan="3">Balance | ||

|---|---|---|

| Wallet balance(*): | 18.461 | B |

| Market sell-orders: | 12.943 | B |

| Market escrow: | 2.359 | B |

| Contracts: | 0.000 | B |

| Investments / receivable: | 1.400 | B |

| Liabilities / payable (**): | (19.400) | B |

| Total: | 15.763 | B |

(*) This amount includes the Investors principal for a total of 15B and interest.

(**) This amount includes the Investors principal plus interests plus other liabilities.

| 1">audit-record" style="text-align: left;" colspan="3">Assets | ||

|---|---|---|

| POS: | 0.000 | B |

| Fleet / ships (unfitted): | 0.766 | B |

| Modules: | 2.887 | B |

| Misc. solid assets; minerals, salvage, ice and trade goods etc.: | 0.246 | B |

| Blueprint copies and originals: | 0.001 | B |

| Other: | 0.000 | B |

| Ordered assets under construction: | 0.000 | B |

| Total: | 3.900 | B |

Estimated grand total: 19.663 Billion ISK

Right before end of bond assets and balance

| 1">audit-record" style="text-align: left;" colspan="3">Balance | ||

|---|---|---|

| Wallet balance (*): | 27.177 | B |

| Market sell-orders: | 23.246 | B |

| Market escrow: | 3.376 | B |

| Contracts: | 0.000 | B |

| Investments / receivable: | 1.400 | B |

| Liabilities / payable (**): | (25.400) | B |

| Total (*): | 29.799 | B |

(*) This amount includes the Investors principal for a total of 15B and interest.

(**) This amount includes the Investors principal plus interests plus other liabilities.

| 1">audit-record" style="text-align: left;" colspan="3">Assets | ||

|---|---|---|

| POS: | 0.000 | B |

| Fleet / ships (unfitted): | 0.345 | B |

| Modules: | 0.073 | B |

| Misc. solid assets; minerals, salvage, ice and trade goods etc.: | 0.078 | B |

| Blueprint copies and originals: | 0.001 | B |

Other | ||

| Accessories: | 0.000 | B |

| Charges: | 0.317 | B |

| Commodities: | 0.000 | B |

| Drones: | 0.010 | B |

| Ordered assets under construction: | 0.000 | B |

| Planetary items or resources: | 0.000 | B |

| Ship components: | 0.000 | B |

| General or classified items: | 0.036 | B |

| Total: | 0.860 | B |

Estimated grand total: 30.659 Billion ISK

The above evaluations were made by using The Forge prices as reference.

Performance analysis

The following are some numbers about how the bond proceeded:

- Top value item bought for resale: 24.626B in buy orders, yielded to 25.388B sales.

- Broker fees paid: 1.045B. Total transaction taxes paid: 0.443B.

- Number of market transactions made: 56,130 (buy 13,141, sell 42,989).

- Total market turnover, including taxable income: 953.705B.

- Best markup per item: 137%, average for the top 10 items is 63%.

- The Investee traded 710 kinds of items. Total gross income has been 501.674B. Total gross expenses have been 452.030B. Total capital moved has been 953.705B. Gross profit has been 49.644B.

- NAV increase from the beginning of this audit to end of bond: 9.996B. This means that thanks to the bond, the Investee managed to increase his NAV by 156%.

Markets analysis

Follows a number of graphs that give a visual representation to the numbers above.

The full size version is available by clicking on the pictures (only on the PAR web site).

Graphs key: green = profit, red = loss, yellow = gross sales.

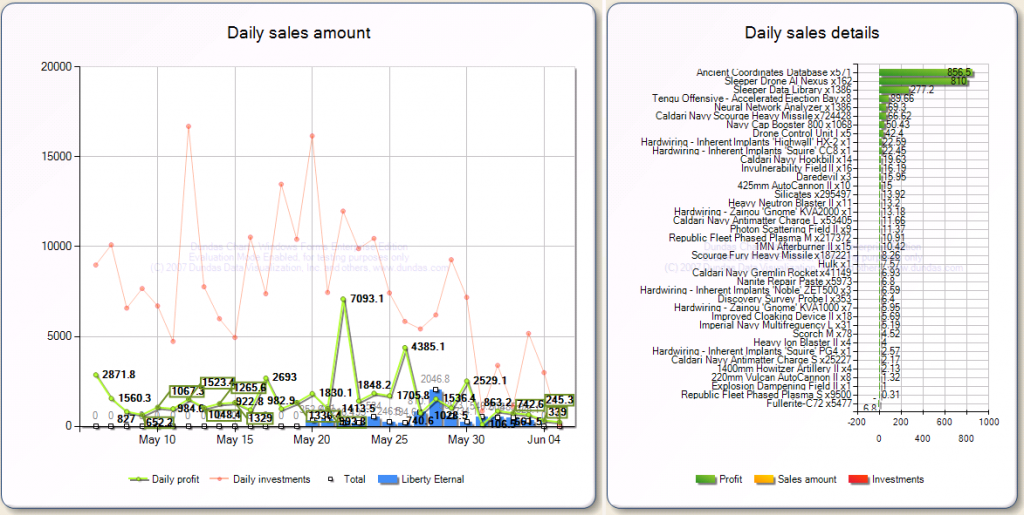

Daily sales amount, profits and losses

Due to limitations of the software, the graph covers the last 30 days of the bond.

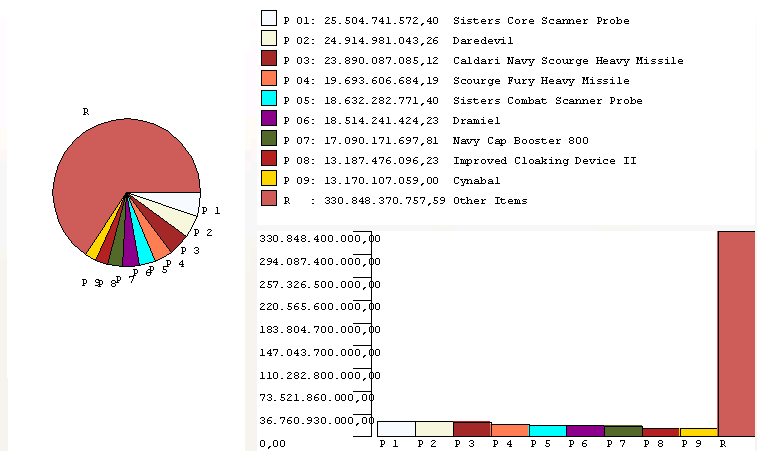

Top gross profit items

The graph below shows the top gross profit items. Taxes are not calculated.

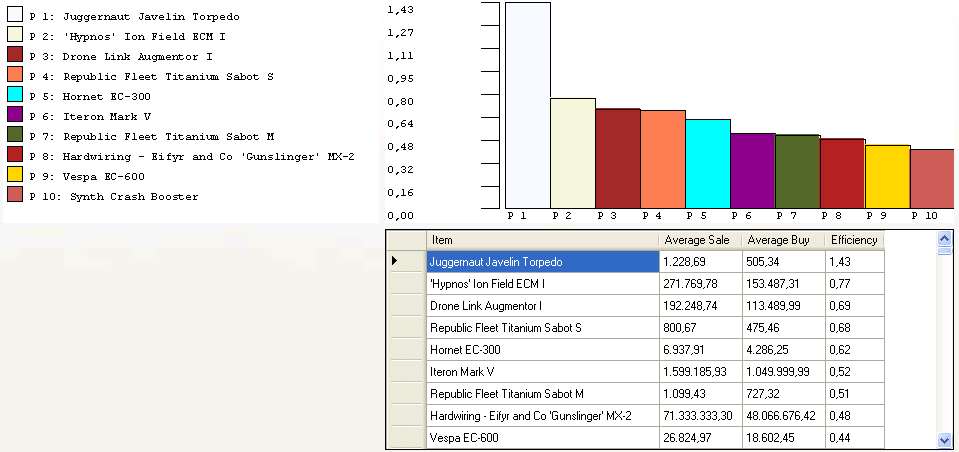

Top most profitable products

The graph below shows the top most profitable items in absolute value. The indicated efficiency is based on gross profit. I.e. the top item shows 143% (1.43), the performance analysis section above shows the net value: 137%.

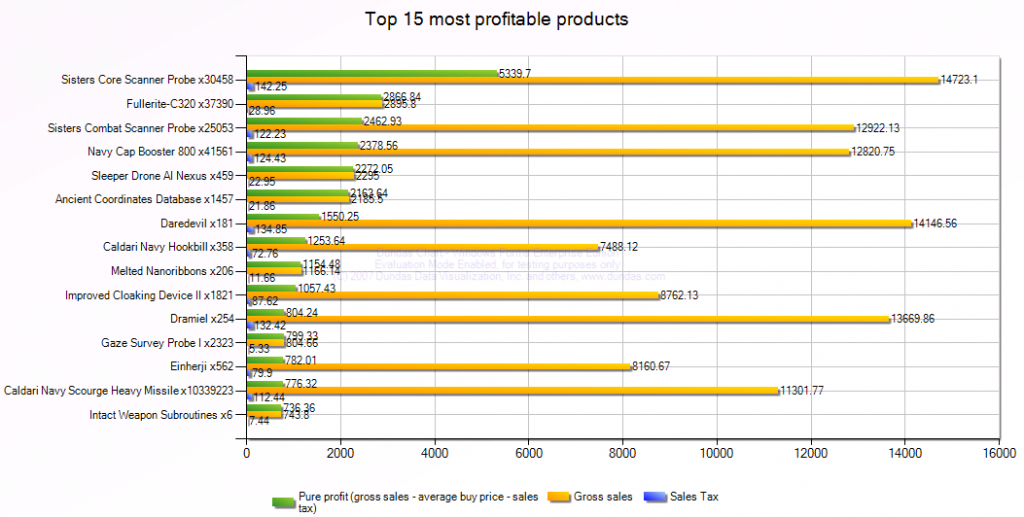

Top 15 most profitable products

The graph below shows the top 15 most profitable items in absolute turnover value.

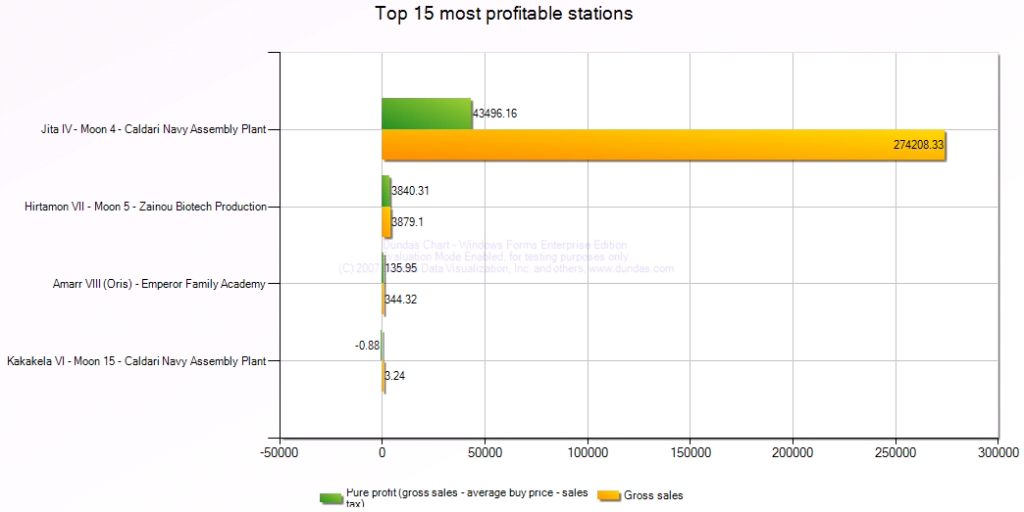

Top most profitable stations

The graph below shows the top most profitable stations.

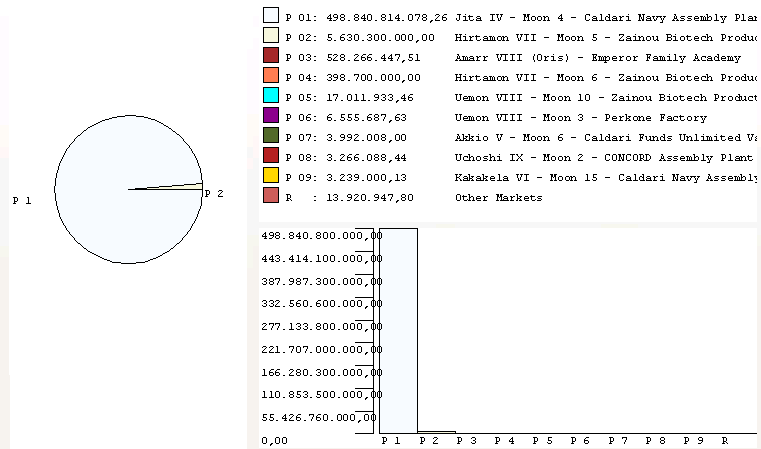

Top turnover markets

The following graph shows the top turnover markets. All the values don’t take into account taxes.

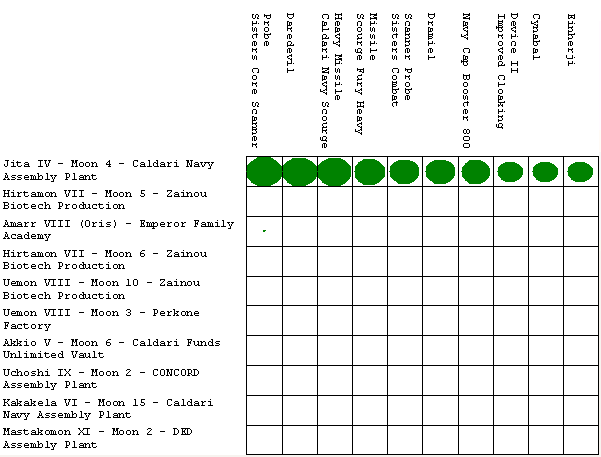

Best selling items per station

This graph shows the best selling items per station.

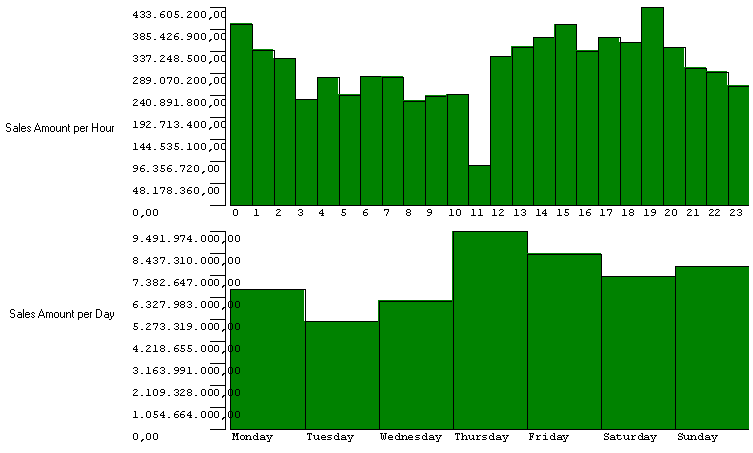

Trading hours

This graph shows the trading hours and volume.

Selling speed

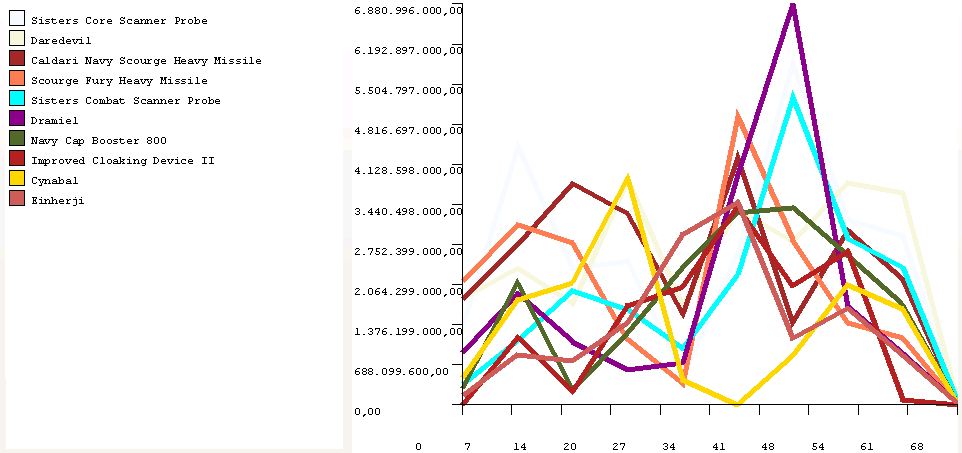

The following graphs show the selling speed for the top items. Each item has a line showing how many sold per given period.

Disclaimers

Due to stringent EvE API limitations, although the information provided to you on this document is obtained or compiled from sources believed to be reliable, Vahrokh Consulting cannot and does not guarantee the accuracy, validity, timeliness, or completeness of any information or data made available to you for any particular purpose.

This Auditor is actively and passionately against any breach of privacy, in particular regarding in game mail API access. Therefore no information will ever be gathered and no audit will ever be released that will contain any element found by eavesdropping someone else’s private communications.

Neither the information nor any opinion contained in this document constitutes a solicitation or offer by Vahrokh Consulting or its affiliates to buy or sell any securities, assets or services.