This is the first installment of VEMEX.

VEMEX stands for Vahrokh’s EvE Mercantile Exchange.

VEMEX is a corporation whose business is to manage a multi purpose facility providing free or subscription based financial services.

The currently available services are listed below:

- VEMEX Exchange, the marketplace where funds, stocks and other securities may be traded.

The current iteration of the exchange may be freely accessed by going to this location.

Some instructions with screenshots about how securities orders may be entered may be found here.

While the exchange is open to all sorts of stocks and investments, it was born to host Vahrokh’s Financial Technologies (VAHFT) financial products. For a listing, prospectus and other information about those securities please refer to VAHFT’s own section on this web site.

Current exchange fees- Open end funds shares are applied a 0% front load and a 1% deferred load. This means that every time you buy a share you don’t pay anything. Every time you sell a share, you pay a fee equal to 1% of the share market value.

- Close end funds shares are applied a 0% front load and a 2% deferred load. This means that every time you buy a share you don’t pay anything. Every time you sell a share, you pay a fee equal to 2% of the share market value.

- Stocks shares are applied an 1% frond load and a 1% deferred load. This means that every time you buy or sell a share you pay a fee equal to 1% of the share market value.

Orders execution rules and timing- The order matching ruleset implemented by this exchange is a FIFO based one. Orders that would sit at the same price will be sorted so that who created the order first is the one whose orders are also delivered first. The orders’ time stamp is the decision factor that determines the order of their execution.

- As of now the exchange is implemented with a tellering system. This means execution is not immediate. Investors are still guaranteed that their orders will be honored in the order they arrive to the exchange. The order sent time will be used as order time stamp.

- Investors are required to always check the “Last Updated” field on the exchange and, depending on how old the last update is, take an informed decision about whether to initiate an order or not.

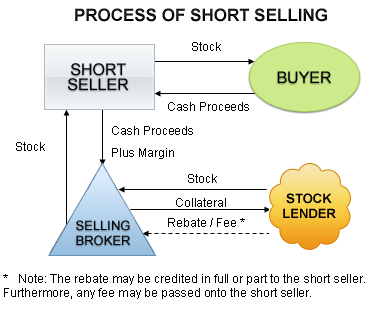

Short sell orders Short sell orders are a particular kind of orders that may be placed by an Investor who believes the market is going to decline and wants to profit from such situation. A short sell order is a functional inverted mirror of a regular buy order, the Investor is meant to short sell at an higher price and take profit when the market drops to a lower price. Short selling involves a fairly complex mechanism involving up to four parties.

Short sell orders are a particular kind of orders that may be placed by an Investor who believes the market is going to decline and wants to profit from such situation. A short sell order is a functional inverted mirror of a regular buy order, the Investor is meant to short sell at an higher price and take profit when the market drops to a lower price. Short selling involves a fairly complex mechanism involving up to four parties.

In the current VEMEX implementation an Investor will have to deposit 25% of the current stock value as margin. VEMEX will setup the various parties with no additional involvement for the Investor.

Example: a share costs 2M ISK and the Investor wants to short sell 10 of them, this means that he has to deposit 5M ISK as margin.

If the market goes against the Investor, it counts against his margin. If he is losing enough that he is losing (5M – exchange trading fees) in value he’ll get a margin call and the exchange will begin automatically closing his positions.

Like for a Real Life exchange, in VEMEX, “closing the positions” means buying (since the Investor is short selling, he has to buy stock in order to close the trade) with market orders. If no order is present, the automatic share current value redeeming mechanism (if any) will take effect.

VEMEX reserves the undisputable right to disable short selling at any time.

- Public Investments Archive, a repository of EvE public investments where Vaerah Vahrokha had some involvement with (usually as consultant or auditor).

- Public Audits Records, a repository of EvE public audits by Vaerah Vahrokha.

It’s possible to have your investment added to the archive for future reference by contacting Vaerah Vahrokha herself.

Each of the above links leads to the index of the relevant repository. It’s also possible to search both archives by NEISIN code.

Instructions:

- Have the NEISIN code for the desired investment or audit ready.

- Enter such code in the web site search box. The available search options are listed below.

- Records fulfilling the search criteria will be shown in this central area of the web site.

- The results also contain a link to the original investment Market Discussion forum thread.

Available search criteria:

- Partial names or codes are supported, so it is possible to find every investment made by a certain corporation or a particular type of investment issued by a certain corporation.

- It’s possible to search by NEISIN code or a part of it.

- If the NEISIN code is not known, it is possible to search by investment publication date (on the EvE forums), by using a YYYY-MM-DD date format.

- It’s also possible to search by Investee / manager / proponent name. The list of all the matching investments will be shown.

- By prepending “investment-” to the NEISIN, only investments will be shown. Audits and anything else won’t appear.